Pledges, Luck and Reading Machines

Your weekly 5 things from the mind of Miles Lasater

Happy Saturday! Here are your 5 things from the mind of Miles for this week.

Founders Pledging. As we setup the venture studio, I’ve been thinking about making a personal pledge about donating a percentage of my earnings. I did this privately and informally with Higher One. Now there are more formal structures and I’ve learned more about the positive externalities to talking about such pledges. For example, one formal program is Founders Pledge. (BTW I had the creator of Founders Pledge on the podcast.) They have since restructured their program and I’m learning more. Have you done something similar? How did you choose an amount? Did you like this one or do you like others?

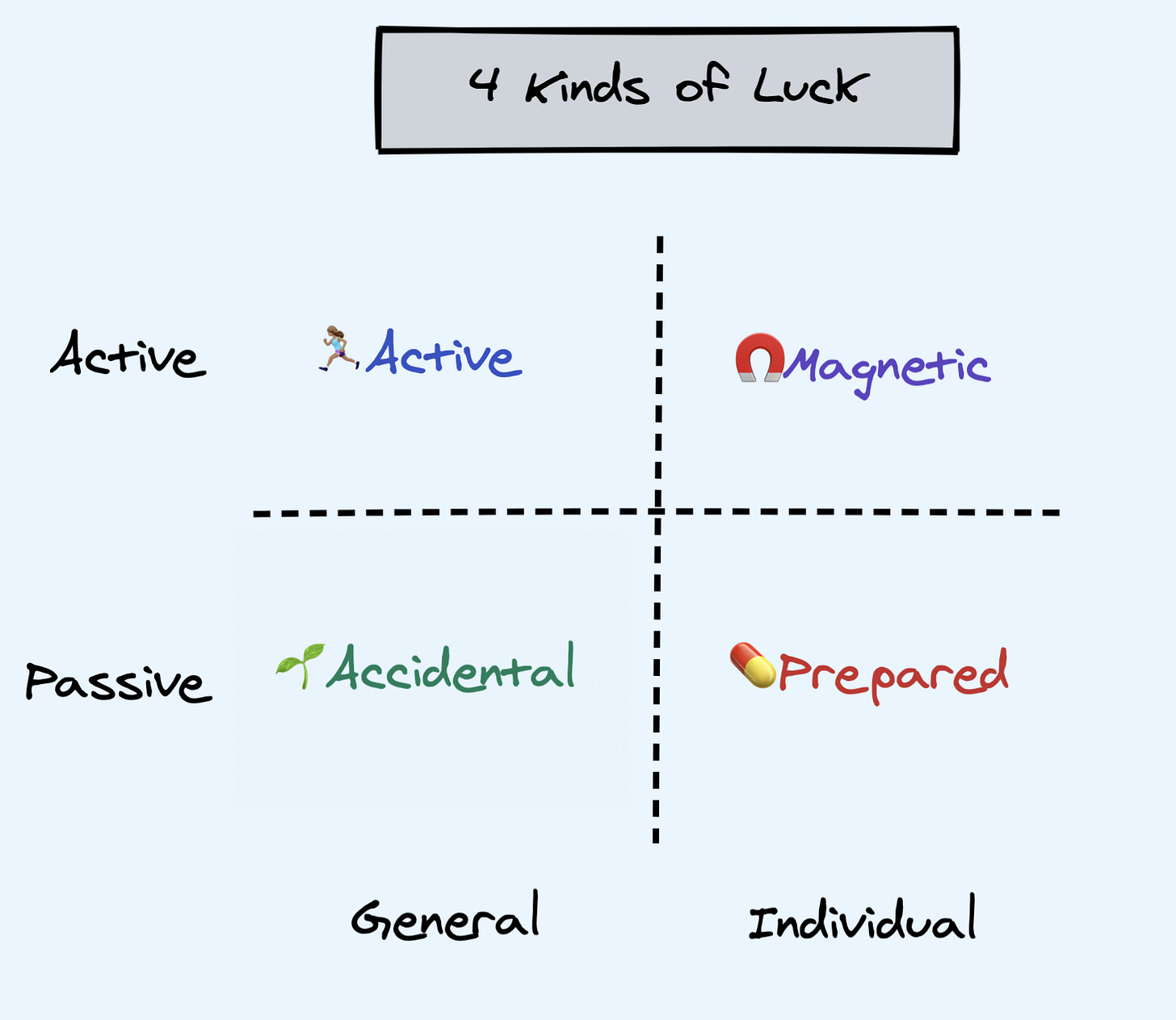

Luck. Views on luck are fascinating and decisive. How should you think about it? My brother recently shared this interesting categorization of luck. Also, I recommend the thought-provoking book Success and Luck. One argument it makes well is that the more skill and work a field takes and the more the competition is fierce, the larger the role of small unpredictable factors. How do you hold multiple truths in your mind at once: (a) hard work matters (b) skill matters, and (c) luck matters? Perhaps prospectively focusing on your own hard work and skill building while retrospectively focusing on how luck contributed to your outcome? And when thinking of others try to see the full picture? (If you are having trouble seeing the role of luck in your life, consider these two questions: given the role of your genes in your capabilities, how lucky was it that you have meta-talents like the ability to work hard or to learn? Also, how lucky is it that at the time you are living society values your particular talents?)

Floors and Ceilings. What are the conditions under which floors become ceilings or ceilings become floors? This happens with regulation, negotiation, goals and parenting. For example, the goal of setting a cap on the profit a vendor might receive, you might pay them their costs plus a percentage profit. But then rather than capping profit, you may have given them a license to increase profit by increasing the costs. I’m told the Affordable Care Act has such a provision and that has contributed to price increases. If you tell someone that the lowest price you will accept is X, when does that set X as the max price they will pay? If you pledge to give away a certain minimum percentage of your earnings, does that become the maximum that you give? Or if you ask someone to wash their hands for at least 30 seconds, you are likely to get a behavior with 30 seconds as the maximum time.

Another Take on Valuations. How expensive is the public stock market? Here is another perspective: “Over the last year, the S&P 500 price return has been 26.9%. Earnings growth has contributed 34.5% while multiples have actually CONTRACTED and contributed -7.6%. Corporate profit margins are still near all times highs (13.2%) but have flattened off. Labor has seen a sharp rise in the % of profits they are seeing since the pandemic began (55%). S&P 500 continues to be very concentrated. The top 10 makes up 30.5% of the index now, but only contributes 25.8% to earnings.” Data from JPM with commentary from Katelyn Donnelly. Is this right that PE multiples have actually gone down? And what is causing the high corporate profit margins?

A Reading Machine. When I was a kid I desperately wished for a reading machine. I had trouble learning to read but I loved books. The world has come a long way since then! Not only did I learn to read, but Audible! But I still want a reading machine. So, sometimes I sync a Kindle ebook and audible book for max comprehension and pacing. But it is expensive and only for books that a human has recorded. Speech to text has improved enough, can’t a computer read to me now? I want something that will highlight on the screen the word or phrase while reading it aloud at ~500 WPM. I saw an ad for such a product but the online reviews were so bad I was reluctant to try it. What’s your favorite solution?

Until next week,

Miles